A modern and successful approach to handling transactions is important in nowadays’s company setting. Payment orchestration has emerged as a significant Device for enterprises trying to enhance their financial procedures. The job of Sophisticated platforms in facilitating seamless payment integration for both equally B2B and B2C enterprises has become ever more well known, showcasing a wide spectrum of detailed methods built to tackle different market desires.

A robust infrastructure is significant for corporations to deal with and route payments properly. This infrastructure supports enterprises in retaining operational efficiency even though improving purchaser pleasure. By providing a big range of payment methods, platforms in this space empower companies to streamline their workflows and focus on delivering exceptional providers for their clientele. Whether it will involve on-line transactions, recurring billing, or multi-forex processing, enterprises can enormously reap the benefits of adopting multipurpose and scalable payment programs.

Among the vital options of such devices is a chance to take care of cross-border transactions with ease. Enterprises operating on a worldwide scale have to have methods that will adapt on the complexities of Global commerce. From taking care of forex conversions to ensuring compliance with regional rules, this kind of platforms Engage in a pivotal job in maintaining the integrity of transactions even though lessening operational bottlenecks.

Inside the context of companies serving both of those B2B and B2C markets, payment orchestration serves being a bridge amongst The 2 designs. These platforms make it possible for businesses to cater to a diverse assortment of shoppers when keeping overall flexibility inside their payment processes. Whether a company is dealing with substantial-scale enterprises or specific shoppers, it could possibly trust in an adaptable framework that accommodates different transaction measurements and specifications.

Extensive payment methods are equipped to assist several payment techniques, which includes bank cards, digital wallets, lender transfers, and different payment alternatives. This wide variety makes certain that consumers can opt for their desired payment strategy, thereby improving their In general encounter. The ability to integrate with current techniques and offer you real-time facts insights even more adds to the worth provided by these solutions.

Safety continues to be a top rated precedence for firms in nowadays’s digital age. Platforms providing Innovative payment abilities position sizeable emphasis on guarding delicate fiscal information and facts. With options including tokenization, encryption, and fraud detection resources, they be certain that transactions are performed in a very protected and reputable method. These safeguards are essential for protecting The boldness of consumers and associates alike, fostering extended-expression organization relationships.

Versatility and scalability are important things for companies aiming to stay aggressive inside a dynamic Market. Payment orchestration platforms offer the agility necessary to adapt to transforming purchaser needs and technological developments. By giving firms Together with the resources to manage fluctuating transaction volumes and accommodate expansion, these methods help organizations to achieve sustained achievement.

Also, enterprises gain from the centralization of payment administration. By consolidating payment processes in just a unified platform, firms can simplify their functions and reduce the executive stress affiliated with handling several payment service suppliers. This centralization not merely improves effectiveness but in addition allows for more effective cost management.

Data analytics and reporting are additional rewards made available from extensive payment solutions. These platforms supply enterprises with important insights into transaction developments, client habits, and economical effectiveness. By leveraging this information and facts, organizations might make knowledgeable selections and put into practice procedures that drive progress and profitability.

A crucial element of recent payment devices is their ability to integrate with different 3rd-occasion apps. This interoperability boosts the features of your platform, enabling businesses to customise their payment workflows to accommodate their unique wants. No matter whether it includes integrating with e-commerce platforms, ERP systems, or accounting application, the pliability of such answers makes certain seamless Procedure throughout unique company features.

For corporations centered on optimizing their payment processes, the adoption of Superior systems which include equipment Mastering and artificial intelligence is now significantly common. These systems enable platforms to recognize patterns, forecast purchaser Choices, and detect likely fraud in true time. By incorporating clever applications into their payment strategies, businesses can increase their operational efficiency and safeguard their financial transactions.

The global bluesnap nature of modern commerce demands options that can navigate the complexities of international markets. Payment orchestration platforms tackle this need to have by providing multi-forex help, localized payment methods, and compliance with assorted regulatory prerequisites. These capabilities enable businesses to expand their get to and create a existence in new markets with self confidence.

Client encounter performs a central function while in the accomplishment of any business. By supplying a seamless and productive payment course of action, corporations can enhance client pleasure and loyalty. The opportunity to supply a frictionless payment journey, from checkout to confirmation, is a critical Consider building a favourable name and attracting repeat small business.

Among the list of issues confronted by organizations is managing disputes and chargebacks. Payment orchestration platforms simplify this method by supplying instruments to trace, handle, and solve disputes effectively. By reducing the executive stress connected with chargeback administration, these methods enable firms to focus on their own Main functions and boost their General efficiency.

Besides their operational Rewards, Sophisticated payment units contribute to a company’s money wellness by reducing transaction fees and optimizing payment routing. These cost price savings are notably substantial for businesses managing a higher volume of transactions, as they might Use a immediate influence on profitability.

Another advantage of these platforms is their power to assist membership-based mostly company styles. With options such as automated billing, recurring payments, and membership administration, they allow organizations to cater to customers who prefer flexible payment preparations. This ability is particularly important in industries which include application-as-a-support, media streaming, and e-commerce.

Organizations aiming to scale their operations require methods which will expand with them. Payment orchestration platforms supply the scalability necessary to take care of expanding transaction volumes and accommodate increasing services or products lines. By furnishing a responsible and adaptable infrastructure, these programs allow companies to obtain their progress objectives with no compromising on performance.

Collaboration amongst companies and their payment service companies is important for achievement. By partnering with platforms that offer an extensive suite of solutions, companies can leverage experience and methods to optimize their payment tactics. This collaboration not only enhances the caliber of support shipped to buyers but in addition strengthens the Group’s aggressive position on the market.

The opportunity to customize payment workflows is usually a essential function of recent platforms. Corporations can tailor their payment processes to align with their specific operational prerequisites and shopper Choices. This customization boosts the overall performance of the payment technique and makes sure a far more personalized experience for conclude-end users.

Regulatory compliance is an additional significant thought for organizations functioning in diverse marketplaces. Payment orchestration platforms simplify compliance by providing applications and resources to navigate sophisticated regulatory landscapes. By guaranteeing adherence to legal and business benchmarks, these alternatives secure enterprises from probable challenges and liabilities.

The integration of cell payment selections can be a developing development during the marketplace. As far more shoppers count on mobile products for his or her transactions, businesses need to adapt to fulfill this need. Platforms that help cell payments enable companies to offer a easy and person-helpful expertise for his or her prospects, thereby improving engagement and gratification.

Innovation is really a driving pressure during the evolution of payment techniques. By keeping within the forefront of technological developments, firms can retain a competitive edge and provide remarkable price to their consumers. Payment orchestration platforms Engage in a central purpose in facilitating this innovation, enabling businesses to experiment with new technologies and put into action cutting-edge methods.

The value of transparency in payment processes can't be overstated. Firms and clients alike benefit from crystal clear and accurate transaction facts. Extensive payment methods give detailed reporting and tracking abilities, making sure that each one functions have usage of the information they should make educated decisions.

Sustainability is undoubtedly an rising consideration for organizations during the payments business. By adopting eco-helpful methods and reducing their carbon footprint, companies can show their determination to environmental accountability. Payment platforms that prioritize sustainability lead to those attempts by optimizing transaction processes and reducing waste.

In summary, the adoption of modern payment devices offers quite a few benefits for corporations of all sizes and industries. By leveraging advanced technologies, comprehensive alternatives, and a world standpoint, businesses can streamline their operations, boost buyer satisfaction, and reach sustainable expansion inside of a aggressive Market. The combination of these platforms into present enterprise procedures is usually a strategic expense that delivers long-time period worth and positions enterprises for achievement inside the electronic overall economy.

Luke Perry Then & Now!

Luke Perry Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Val Kilmer Then & Now!

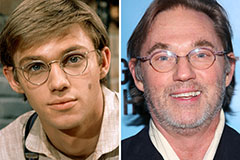

Val Kilmer Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!